CompMetrics, LLC

Property Tax Services

CompMetrics LLC is a boutique firm that provides property tax consulting, valuation, advisory and data analytics services with primary focus in North Texas. We offer the following services:

Property Tax Consulting

At CompMetrics, we fully understand the methodologies used in mass appraisal for ad valorem tax assessment and the complexities of the property tax appeal process. Our years of experience in ad valorem mass appraisal, property tax consulting and valuation, enables us to provide reliable and credible consultation services to our clients. To consistently meet our goals and clients’ expectations, we utilize a pragmatic and detailed approach in our value negotiations with the appraisal districts.

Property Tax Valuation

CompMetrics LLC, provides property tax valuation services for property tax appeal purposes, including a Uniform and Equal valuation report for unequal appraisal protests. We provide a full range of property tax valuation services, and our professionals have experience with all major property types, including land, residential, multifamily apartments, office, retail, and industrial real estate; restaurants, senior living facilities, healthcare and hospitality.

Property Tax Advisory and Analytics

Transforming data into useful information is key to business decisions. For an investor or owner of real estate, understanding the impact of property tax on pre-acquisition and operation cost can make a significant difference in making a timely and insightful decision. Our property tax advisory and data analytics services provide our clients with the necessary guidance in making better informed decisions today and tomorrow. The use of property tax data analytics allows the client to uncover property tax trends for better budgeting and planning.

Cost Segregation Studies

Our Cost Segregation services enable owners of commercial real estate to increase their cash flow and save significantly on their taxes. The purpose of our Cost Segregation service is to accelerate depreciation by identifying items that should be properly classified as depreciable fixed assets (building and personal property components) and non-depreciable fixed asset (land component). Our professionals will identify the various components of the building and assign these components their rightful life and portion of the overall cost basis.

Property Types

CompMetrics provides full property tax services for most property types including:

Residential

Single-family units, condominium and townhome units, and 2-4-unit residential dwellings.

Single-Family Home

Condominium

Townhome

Duplex

Commercial

Multifamily apartments, senior and assisted living facilities, nursing homes, shopping centers/retail, offices, hotels and motels, hospitals, medical centers, medical offices, drug stores, restaurants, banks, gas stations, convenient stores, fast food chains, and daycare centers.

Apartments

Retail Center

Office Building

Medical Center

Hotel

Restaurant

Gas Station

Bank

Industrial

Storage buildings, warehouses and office showrooms, manufacturing and food processing plants, flex industrial buildings, technical/R&D buildings, and truck terminals.

Storage Buildings

Warehouse

Flex Industrial

Office Showroom

Manufacturing Plant

Truck Terminal

Business Personal Property (BPP)

Includes: Inventory, Fixed Assets / Machinery and Equipment (M&E).

Inventory

Office Furniture

Machinery

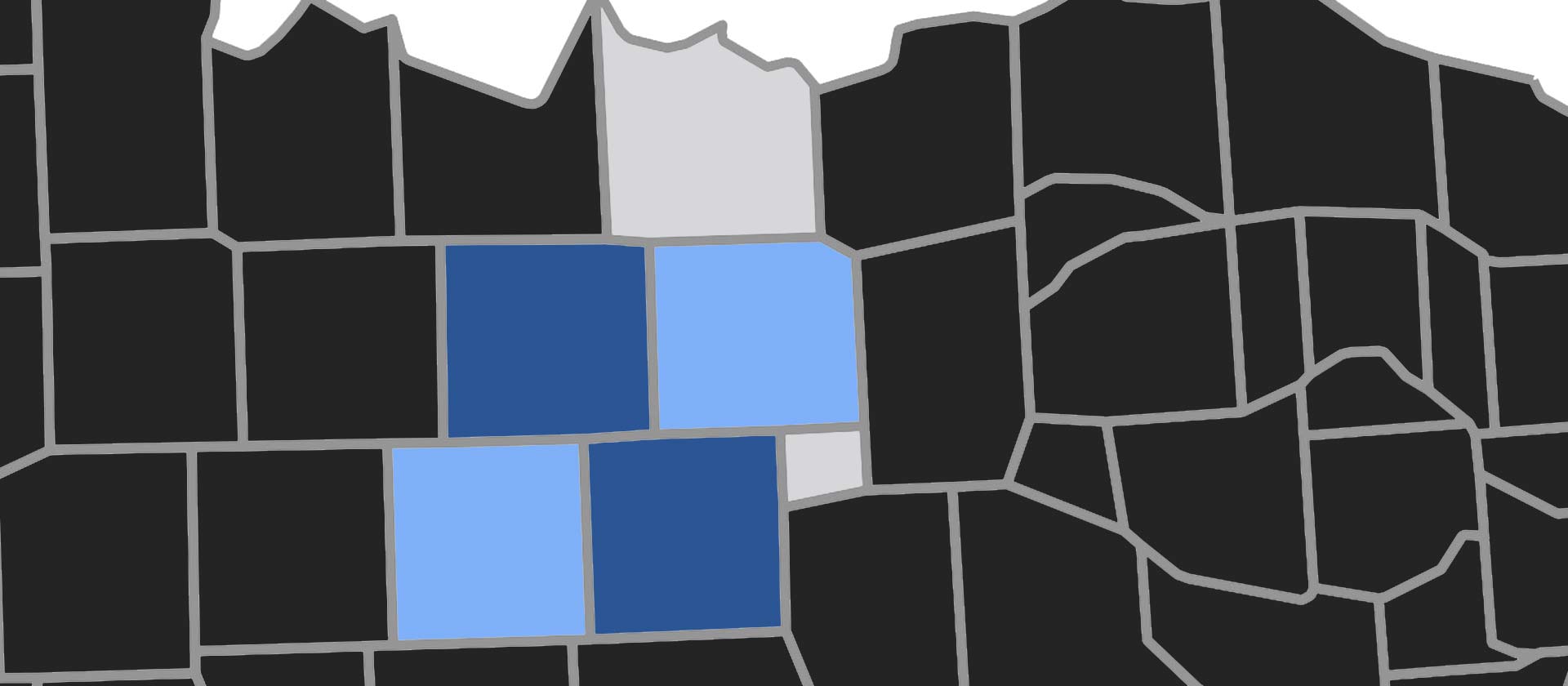

Our Coverage Area

Our Service County Areas Include:

Dallas

Denton

Collin

Tarrant

Grayson

Rockwall

CompMetrics, LLC

Property Tax Services

CompMetrics LLC is a boutique firm that provides property tax consulting, valuation, advisory and data analytics services with primary focus in North Texas. We offer the following services:

Property Tax Consulting

At CompMetrics, we fully understand the methodologies used in mass appraisal for ad valorem tax assessment and the complexities of the property tax appeal process. Our years of experience in ad valorem mass appraisal, property tax consulting and valuation, enables us to provide reliable and credible consultation services to our clients. To consistently meet our goals and clients’ expectations, we utilize a pragmatic and detailed approach in our value negotiations with the appraisal districts.

Property Tax Valuation

CompMetrics LLC, provides property tax valuation services for property tax appeal purposes, including a Uniform and Equal valuation report for unequal appraisal protests. We provide a full range of property tax valuation services, and our professionals have experience with all major property types, including land, residential, multifamily apartments, office, retail, and industrial real estate; restaurants, senior living facilities, healthcare and hospitality.

Property Tax Advisory and Analytics

Transforming data into useful information is key to business decisions. For an investor or owner of real estate, understanding the impact of property tax on pre-acquisition and operation cost can make a significant difference in making a timely and insightful decision. Our property tax advisory and data analytics services provide our clients with the necessary guidance in making better informed decisions today and tomorrow. The use of property tax data analytics allows the client to uncover property tax trends for better budgeting and planning.

Cost Segregation Studies

Our Cost Segregation services enable owners of commercial real estate to increase their cash flow and save significantly on their taxes. The purpose of our Cost Segregation service is to accelerate depreciation by identifying items that should be properly classified as depreciable fixed assets (building and personal property components) and non-depreciable fixed asset (land component). Our professionals will identify the various components of the building and assign these components their rightful life and portion of the overall cost basis.

Property Types

CompMetrics provides full property tax services for most property types including:

Residential

Single-family units, condominium and townhome units, and 2-4-unit residential dwellings.

Single-Family Home

Condominium

Townhome

Duplex

Commercial

Multifamily apartments, senior and assisted living facilities, nursing homes, shopping centers/retail, offices, hotels and motels, hospitals, medical centers, medical offices, drug stores, restaurants, banks, gas stations, convenient stores, fast food chains, and daycare centers.

Apartments

Retail Center

Office Building

Medical Center

Hotel

Restaurant

Gas Station

Bank

Industrial

Storage buildings, warehouses and office showrooms, manufacturing and food processing plants, flex industrial buildings, technical/R&D buildings, and truck terminals.

Storage Buildings

Warehouse

Flex Industrial

Office Showroom

Manufacturing Plant

Truck Terminal

Business Personal Property (BPP)

Includes: Inventory, Fixed Assets / Machinery and Equipment (M&E).

Inventory

Office Furniture

Machinery

Our Coverage Area

Our Service County Areas Include:

Dallas

Denton

Collin

Tarrant

Grayson

Rockwall